MATLAB®人工智慧 & 金融科技

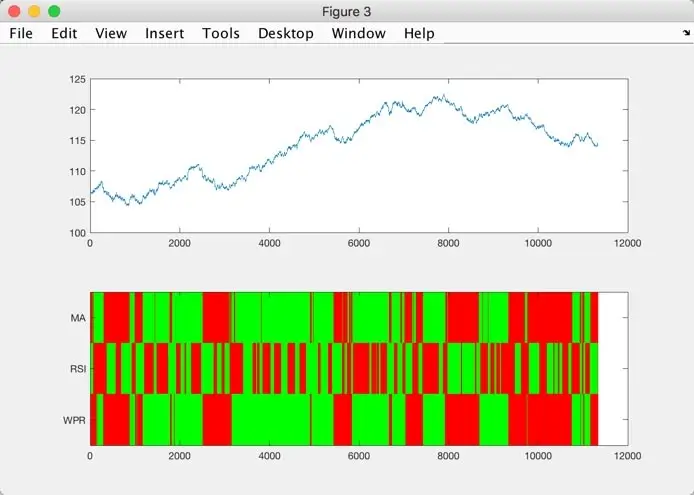

計量金融,風險管理,投資回測,機器學習,程式交易

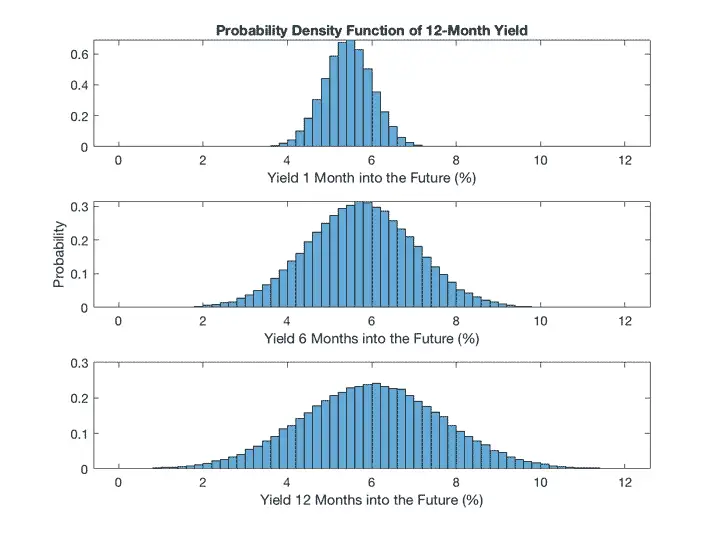

利用MATLAB,您可以客製開發甚至只要幾行的MATLAB程式碼,即能快速建立計量財金模型的原型及進行驗證,此外,您也可以使用平行處理技術加速模型的運算,並直接導入生產或成為商品。

同時,全球各國的政府(如央行或聯邦準備局)及業界領導金融機構更使用MATLAB來決定利率、進行壓力測試,管理數十億美元以上的投資組合,以及進行毫、微秒內等複雜的金融商品交易等等。

- 風險和投資組合分析原型化的速度比R快120倍,比Excel / VBA快100倍,比Python快64倍以上。

- MATLAB能自動產生文檔,無論是進行模型審核,或供監管單位批准的文件都能快速自動產生。

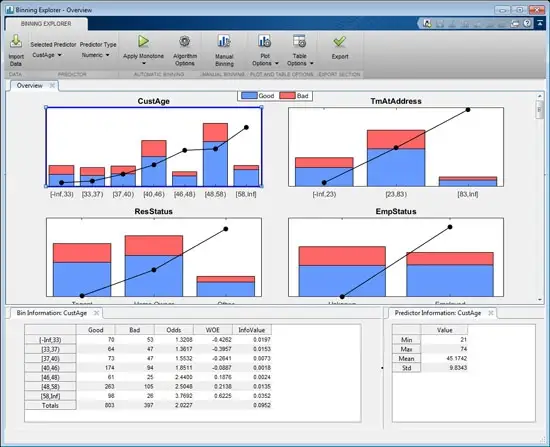

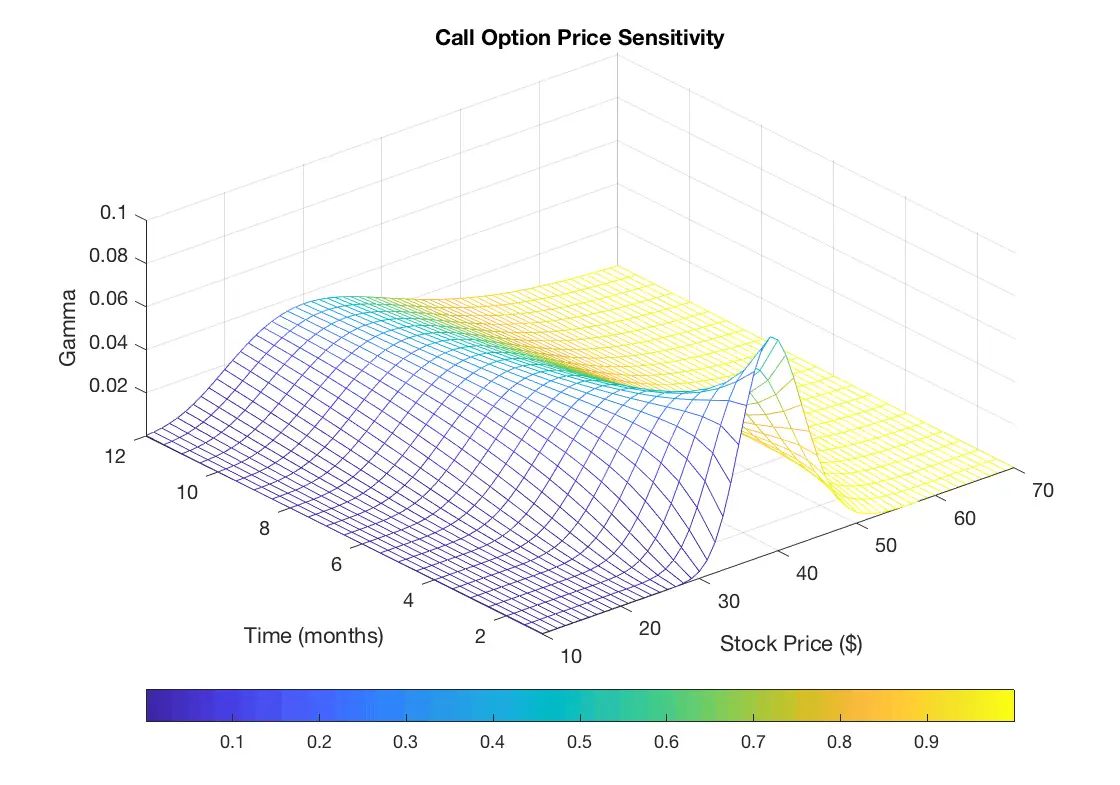

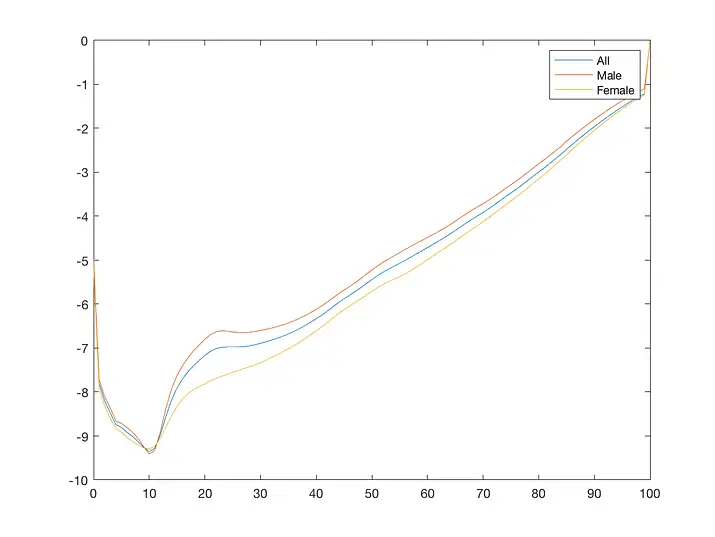

- 分析人員可使用MATLAB預先建立的應用程式(apps)和工具,對模型結果進行視覺化、除錯並對模型進行調校。

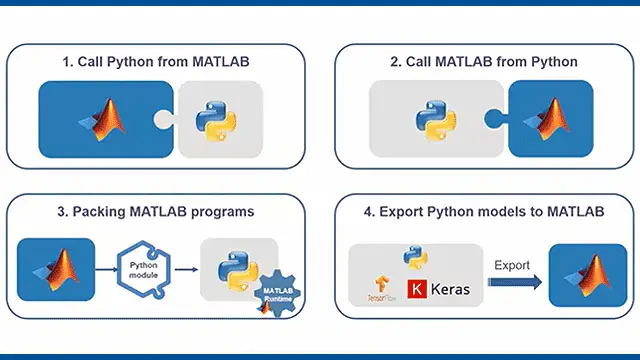

- IT團隊可以將模型打包成具有智慧財產權之執行檔(EXE)或是函式庫(DLL)予其他應用程式使用,如: Excel,Tableau,Java,C ++和Python,並將其運行於一般桌機或Web應用程式上。

- MATLAB內建有可匯入歷史和市場即時數據資料的界面,可匯入的資料源包含免費到付費的彭博(Bloomberg),湯森路透(Thomson Reuters),FactSet,FRED和Twitter等等。

- MATLAB更可處理大數據和串流的資料數據,包括傳統和非主流資料源。

“MATLAB使我們能夠專注在投資於專業人員的核心競爭力上,像是將風險管理進行量化和對投資組合進行的最佳化成效,轉成可視化的操作介面。從導入的第一天起就替我們及跨團隊的合作帶來附加價值。”